The Basics of Transactional Funding

Have you ever questioned how real estate investors are able to complete transactions without using their own money? The answer lies in a financing strategy known as transactional funding.

Transactional funding, also known as flash funding or ABC funding, has become increasingly popular in the real estate industry. A short-term loan option, transactional funding (sometimes referred to as flash or ABC funding) enables investors to finalize deals without having to utilize their own money.

Understanding Transactional Funding in Real Estate

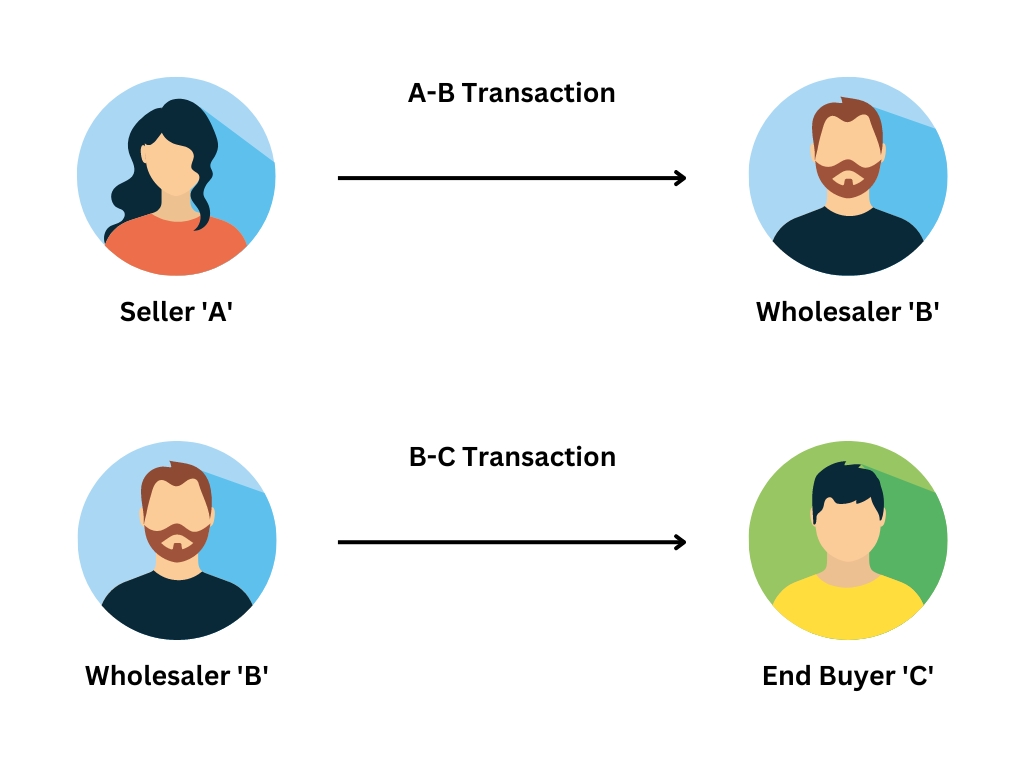

Transactional funding is a short-term loan that involves four key players: the original owner (A), the investor (B), the end buyer (C), and a transactional lender.

Here’s how it works in simple terms:

- The investor enters into a purchase contract with the current owner of the property, creating a deal between A and B.

- The same investor then secures another contract with an interested end buyer for the sale, creating a deal between B and C.

These loans are typically approved within 24 hours to two days, which is why they are often referred to as “flash” funding.

One of the greatest advantages of transactional funding is its versatility. Transactional funding is applicable to a variety of real estate assets, including residential and commercial. This flexibility allows wholesalers and other investors to close on time-sensitive deals.

Now, let’s take a closer look at why many investors choose transactional funding over traditional forms of financing, such as hard money lenders or bank loans.

The Benefits of Using Transactional Funding

Transactional funding offers numerous benefits for real estate investors and wholesalers. This type of OPM (Other People’s Money) financing strategy allows you to close deals swiftly, without the need for personal funds.

Unlike traditional loans, transactional funding does not require proof of income or credit verification. This accessibility makes it an attractive option, even if your financial history isn’t perfect. Additionally, the paperwork involved is minimal compared to traditional loans, streamlining the process significantly.

Transactional Funding vs Traditional Financing Options

When compared to conventional options like hard money loans and bank loans, transactional funding stands out as an attractive alternative. One key advantage is faster approval times. While banks can take weeks or months to approve a loan application, transactional fund lenders often give their nod within 24 hours.

Another advantage is the avoidance of stringent requirements typically found in other forms of financing, such as upfront fees and full title reports. This makes transactional funding appealing for real estate professionals looking for quick turnarounds on their investments.

If speed is your top priority when closing your next deal, consider opting for this innovative form of real estate financing.

How Wholesalers Can Benefit from Transactional Funding

By leveraging transactional funding, real estate wholesalers can gain access to an investment tool that enables them to execute deals without risking their own money. This form of financing offers an avenue to facilitate investment deals without risking personal capital.

A Step-by-Step Guide on Utilizing Transactional Funding Effectively

The first step is identifying and securing a property under contract with a motivated seller. Then, you enter into another purchase agreement, this time with your end buyer lined up and ready to close the deal.

Your next move involves applying for a transactional funding loan.

Once approved, funds are transferred directly into an escrow account, ensuring that the initial purchase goes through smoothly. With cash at hand now, the wholesaler completes the A-B part (original owner-wholesaler) of the ABC funding process successfully.

The final stage comes when the B-C leg (wholesaler-end buyer) closes out. Here’s where all parties get their payback – the original owner gets his selling price, while the wholesaler pockets the difference between what they paid initially versus the sale proceeds received from the qualified end buyer.

In a nutshell, using transaction loans not only helps reduce risk exposure but also opens doors to greater profit margins thanks to its short-term nature coupled with the low interest rates offered by these hard money lenders.

Finding the Right Transactional Fund Lender

As a real estate wholesaler, it is crucial to find reliable transactional fund lenders in order to ensure your success. This process requires careful consideration and due diligence, taking into account factors such as competitive rates and favorable loan terms.

The Importance of Researching Potential Lenders

One way to start your search is by attending local REIA meetings or utilizing Google to find potential leads. These meetings provide an excellent opportunity to network with other investors who may have valuable recommendations.

Your professional network can also be a valuable resource, as they may be able to provide referrals based on their personal experiences with various private money lenders.

Selecting a Private Money Lender: Key Considerations

When selecting a private money lender, it is wise to consider several key factors. First, it is important to avoid lenders who charge hefty upfront fees. Ensure the lender has enough money to finance your purchase price and closing costs in full.

Before making any commitments, it is essential to evaluate factors such as interest rates, origination fees, and extended loan term conditions.

Prioritize Same-Day Funding Providers

In wholesale transactions, time is often limited between the initial purchase agreement with a motivated seller and the closing deal with an end buyer. Therefore, same-day funding becomes indispensable. When choosing transactional lending partners, it is crucial to prioritize lenders who offer same-day funding.

Stay tuned for our next section, where we will discuss how you can overcome challenges associated with transactional fund lending.

However, with transactional funding, poor credit is not a problem.

Given the property being purchased is not dependent on the borrower’s creditworthiness, investors with poor credit can still access this financing option.

Building Relationships with Private Lenders

One of the keys to successfully navigating transactional funding is building relationships with private lenders.

Establishing trust and rapport with lenders who specialize in this type of financing can help you secure funding quickly and efficiently.

Networking at real estate events, joining investor groups, and leveraging online platforms can all be effective ways to connect with potential lenders.

Understanding the Costs Involved

It is critical to be aware of the expenses associated with transactional financing.

While the interest rates may be higher compared to traditional loans, the benefits of quick funding and flexibility often outweigh the additional expenses.

By carefully analyzing the numbers and factoring in the potential profit from the deal, you can determine if transactional funding is the right choice for your real estate wholesaling business.

Conclusion

Transactional funding can be an advantageous asset for real estate wholesalers, yet it’s fundamental to know the difficulties that may come up.

By negotiating extended loan terms, having backup end buyers, overcoming poor credit concerns, building relationships with private lenders, and understanding the costs involved, you can navigate these challenges and maximize the benefits of transactional funding.

With the right strategies and mindset, you can overcome any obstacles and achieve success in your real estate wholesaling endeavors.

FAQs in Relation to Transactional Funding Wholesaling

What is transactional funding for wholesaling?

Transactional funding for wholesaling is a short-term loan used by real estate wholesalers to purchase properties without using their own capital, before quickly selling them to an end buyer.

What is the interest rate for transactional funding?

Interest rates for transactional funding vary widely depending on the lender, but typically range from 1% to 2% of the total loan amount.

How long does transactional funding last?

Transactional funding usually lasts between one day and two weeks. It’s designed as bridge financing to facilitate back-to-back closings in wholesale deals.

How do you use transactional funding?

You can use transactional funds by applying through a private lender who specializes in these loans. Once approved, you’ll use the funds to close your initial property purchase then repay when selling it to your end buyer.

Conclusion

Transactional Funding Wholesaling has opened up a new world of possibilities for real estate investors. It’s the key to swift and smooth deals, free from personal financial risk.

This financing strategy is all about speed, efficiency, and leveraging other people’s money. It bypasses traditional hurdles like credit checks or proof of income.

But it’s not without its costs – origination fees can add up. Yet when managed well, these expenses are just part of doing business smartly.

The power in this approach lies in your hands as an investor or wholesaler. You’re at the helm, steering your ship towards profitable shores with someone else’s capital fueling your journey.

Navigating through potential challenges requires foresight and preparation – but remember that even poor credit doesn’t have to be a roadblock on this path!

Ready to unlock more profits with Transactional Funding Wholesaling? Fund My Double Close, our transformative program designed specifically for wholesalers like you will guide you every step of the way! With us by your side, maximize your earnings while minimizing risks involved in property investment deals. Let’s redefine success together!